In the world of wealth management and financial planning, family offices have emerged as essential entities. But what exactly are family offices, and why do they exist?

A family office is a private organization or advisory firm established to manage the financial, investment, and often, the lifestyle needs of a high-net-worth individual or family (~$50M net worth). These offices typically provide a wide range of services, including investment management, estate planning, tax optimization, philanthropic endeavors, and more. The key distinction of a family office is its exclusivity and tailored approach, as it serves a single affluent family or a small group of families.

Many people use a variety of professionals to manage their assets, including investment, tax, retirement and estate planners. Family offices generally provide these services and more with exceptional experience and performance. Like other savvy investors, they want to collect quality assets and preserve wealth. They are not sheep following common trends nor are they risky rebels who go it alone.

Exceptional risk-adjusted returns

The primary focus of family offices is wealth retention. That is, they do NOT want to lose their money and their investments reflect this. Family offices also have high expectations for returns and seek out the best tax advantages.

Standard investments do not provide uncommon returns.

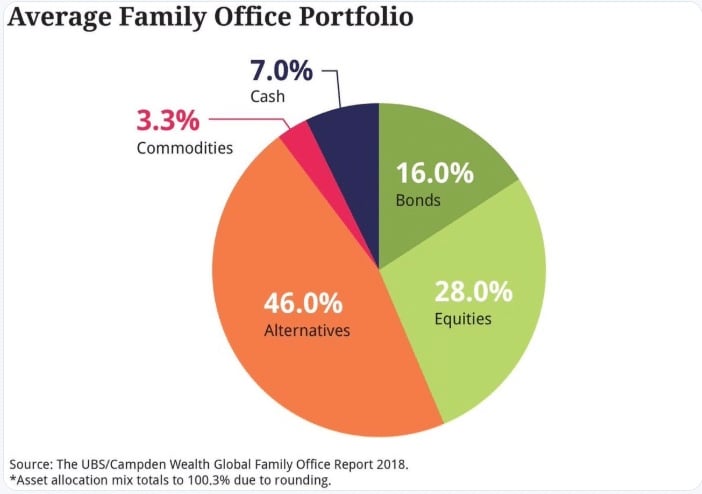

A recent study by UBS/Campden Wealth covers 230 family offices, each handling investments for a single wealthy family. These families possess a combined net worth of almost $500 billion, translating to an average of $2.2 billion per family. According to the study, the top global Family Offices have 46% of their assets in alternative investments.

When you hear “Alternative Investment,” it likely means anything that is not “Wall Street”. It is an investment that is an alternative to Stocks, Bonds, ETFs, and Mutual funds and a big influence for the ‘alternative’ name of Oak Street Assets. Alternative investments most often refers to real estate as recently the term has become synonymous with syndicated real estate deals although there are many other alternative investments.

According to Goldman Sachs’ 2023 family office report, 30 percent of their clients plan to increase their exposure to the real estate sector — in particular, multifamily residential — in the next 12 months.

In fact, we partnered with a family office fund on our last apartment community in Nashville. We flew out this week to meet with our Property Management partner to perform our due diligence on this property. We also stopped by our other communities in Nashville to visually inspect the property and check on-site operations.

Polished Version (July 12, Saturday)

Five Improvements Made:

- Clearer Headings and Subheadings: Improved readability and clear flow.

- Engaging Introduction: Hooks reader interest immediately.

- Simplified Language: Made complex terms more accessible.

- Relevant Data Integration: Better context around research references.

- Lead Magnet Inclusion: “Free Guide: Top 10 Alternative Investments Preferred by Family Offices.”

Where Do Family Offices Invest?

Introduction: Navigating Wealth Management

Are you currently managing your wealth independently, or do you have a team dedicated to helping you achieve your financial objectives? In recent years, family offices have emerged as prominent entities in the wealth management landscape, offering highly personalized services tailored specifically to affluent individuals and families.

But what exactly is a family office, and why might it be beneficial for you?

Understanding Family Offices

A family office is a private advisory organization created specifically to manage financial investments and lifestyle needs of high-net-worth families, typically those with net worths exceeding $50 million. Unlike typical financial advisory services that cater to a broad range of clients, family offices are highly exclusive and offer tailored strategies addressing:

- Investment management

- Estate planning

- Tax optimization

- Philanthropic planning

- Lifestyle management

Family offices bring exceptional expertise and a comprehensive approach to wealth preservation and growth.

What Sets Family Offices Apart?

Family offices stand out by providing:

- Exclusivity: Personalized attention focused solely on the specific family’s goals and values.

- Exceptional Experience: Teams consist of top professionals across finance, tax, law, and philanthropy.

- Risk Management: Strong emphasis on protecting and preserving wealth with superior risk-adjusted returns.

Investing Strategy: Exceptional Risk-Adjusted Returns

Family offices prioritize wealth retention, placing a strong emphasis on avoiding losses. They consistently seek strategies that provide stable, high-quality returns coupled with favorable tax advantages.

Why Alternative Investments?

Family offices prefer alternative investments because standard investments rarely yield extraordinary results. According to a recent UBS/Campden Wealth study surveying 230 family offices managing nearly $500 billion, approximately 46% of their assets are allocated toward alternative investments.

An alternative investment typically refers to assets outside traditional markets such as stocks, bonds, ETFs, and mutual funds. Real estate, particularly syndicated real estate deals, is one of the most popular forms of alternative investments among family offices.

Goldman Sachs’ 2023 Family Office Report highlights this trend, noting that approximately 30% of surveyed family offices plan to significantly increase their real estate investments, specifically multifamily residential properties, within the coming year.