“Most people confuse legacy with a legal document. But true legacy isn’t passed through paper—it’s passed through people.”

1. Why Legacy Needs a Redefinition

The financial industry hijacked the word legacy years ago. For many, it now conjures up images of estate attorneys, wills, and tax strategies. But legacy is far more than a legal construct or a financial maneuver. It’s not something you draft once with a notary. It’s something you build every single day.

Legacy is not about what you leave to your kids.

It’s about what you leave in them.

Look around, and you’ll see the damage of getting this wrong. Lottery winners, trust fund kids, and even some of the wealthiest families in history have left behind trails of broken relationships, addiction, and aimlessness.

Why? Because money without meaning is often corrosive.

At Oak Street Assets, we believe legacy is a life of purpose—lived intentionally, structured wisely, and passed on with love, clarity, and strength. It’s not about net worth. It’s about worthiness.

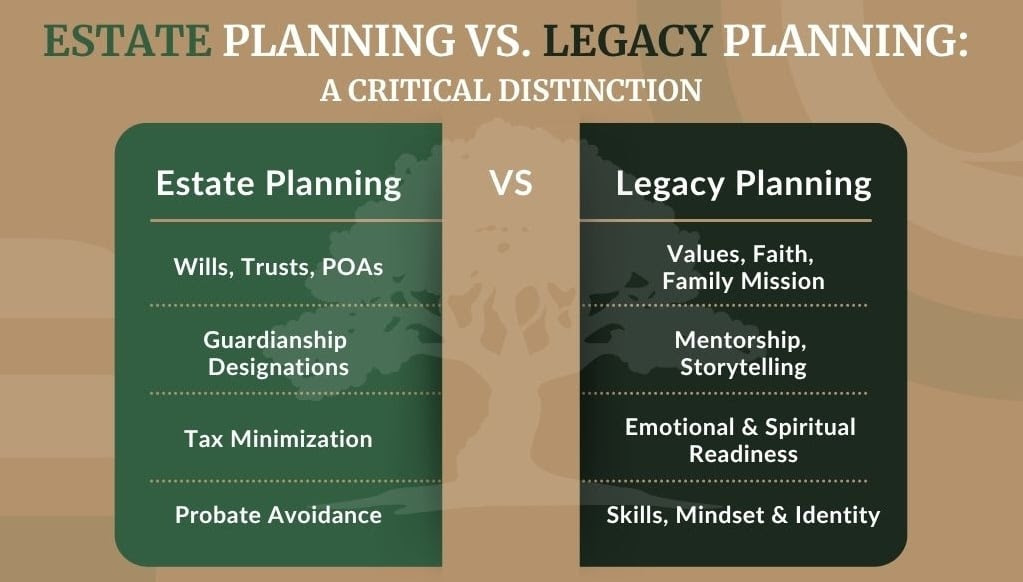

2. Estate Planning vs. Legacy Planning: A Critical Distinction

You need both. But they are not the same.

Estate Planning focuses on structure and protection. It covers wills and trusts, powers of attorney for financial and medical matters, advance directives or living wills, guardianship designations, and strategies to reduce taxes and avoid probate. The goal is simple: protect your assets and make sure they are passed on according to your wishes.

Legacy Planning focuses on meaning and preparation. It includes creating a family mission statement, writing ethical wills or legacy letters, developing charitable giving strategies, mentoring heirs, preserving family stories, and building family identity and governance. The goal is to prepare the next generation for what they will inherit and ensure they understand and carry forward your values.

A real legacy needs both the structure of estate planning and the soul of legacy planning. Without legacy, even the most carefully built estate plans often fall apart within one or two generations. Estate planning gives your assets direction. Legacy planning gives them meaning. Together, they protect what you have and preserve who you are.

Basically, Legacy Planning prepares your heirs for the assets and preserves who you are, not just what you owned.

A real legacy requires both: the structure of estate planning and the soul of legacy planning. Without legacy, estate plans often fall apart within one or two generations.

3. What Real Legacy Looks Like

Would you like a family that wants to get together? Who supports each other?

Do you want generations to gather for special events and a full table at the holidays?

A holistic legacy spans three key dimensions:

Health: Model energy, vitality, and self-discipline. Teach your children how to care for their bodies by caring for yours.

Wealth: Steward resources wisely, build value-creating assets, and train your children to handle money with wisdom and purpose.

Wisdom: Pass down values, spiritual grounding, emotional resilience, and moral courage.

Scott Donnell, founder of Fig and Eagle a family oriented legacy group here in Arizona, defines legacy as raising children who surpass you in character, identity, love, relationships, impact, and financial understanding. That definition resonates with me and my views a lot.

Your net worth won’t define your great-grandchildren—but your HERITAGE will.

4. The Cost of Getting It Wrong

*NOTE: this feels preachy as I write it and please know, I am guilty of these traps too!

Many modern parenting models fall between two extremes:

- The Coddler: ‘Go play video games, I’ll do it for you.’

- The Dictator: ‘You’re a big kid. Figure it out.’

One spoils, the other abandons and the result is usually trouble.

I’m finding that true legacy requires intention and support but that children need healthy struggle. That means chores, responsibility, ownership, and the pain of natural consequences.

Entitlement is the new currency of victimhood. Giving your children a life of ease might feel loving in the moment, but it often produces weakness, confusion, and resentment later on.

Additionally, helping children develop intrinsic motivation is one of the most empowering things we can do for them and providing rewards for participation without effort or results can destroy that by undermining their sense of accomplishment and self-driven purpose.

Referencing Nassim Taleb’s concept of Antifragility, we must build children who grow stronger under pressure. Not immune to adversity—but trained by it.

5. Do you want STUFF or EXPERIENCES?

💡 Life’s work is meant to be shared, not stored.

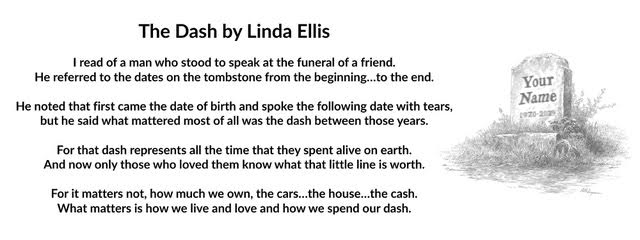

So, when your eulogy is being read, with your life’s actions to rehash… would you be proud of the things they say about how you spent YOUR dash?

Did you know: the most common period to receive an inheritance is between the ages of 55 and 64?

Is that when money would be of best use?

Life is better spent maximizing experiences rather than maximizing wealth. After all, wealth is only valuable if you actually use it.

This is a point worth noting in a Legacy series and is discussed in depth in the popular book ‘Die with Zero’ by Bill Perkins.

Here are some of the main points:

- “Maximize your life experiences.” – The central theme: spend time, energy, and money in ways that bring the most fulfillment, not just accumulation.

- “Invest in experiences, not things.” – Things fade, but experiences grow in value over time.

- “Memory dividends.” – Experiences create lasting returns in the form of joy, memories, and stories that keep paying off emotionally throughout life.

- “Give while you’re alive.” – If you want to give to kids, family, or charity, do it when they (and you) can actually enjoy the benefits.

The ultimate goal is not to leave unused potential (whether money, time, or energy) behind.

❗ Networth is not put on one’s tombstone.

If you only have 18 Summers before your child leaves home, is it better to work and save money during those years to leave them later once you pass?

Of course you can still have time with them and their family when they are grown, but time is the one resource you can not get back.

6. What’s Next: Designing a Legacy that Lives

This series hopes to guide you through designing, building, protecting, and living your legacy:

Part II: Building the Legacy – Creating assets of health, wealth, and wisdom

Part III: Protecting the Legacy – Structures, trusts, and family systems that endure

Part IV: Living the Legacy – Daily practices, coaching, and modeling that keep your legacy alive

Final Thoughts

We’ll talk more about trusts and wills and inheritance planning, including some pretty interesting ones; from the traditional ‘oldest child gets everything’ to Shaq’s education incentives to a ‘Brewster’s millions’ model.

I would love to hear from you on what legacy means to you and what plans you have for creating and maintaining it.

STAY TUNED FOR PART II of the series!