Impact Lending Fund

Our Lending Fund has target, monthly distributions of 8-9%+ (annualized) with 90 day liquidity

Oak Street Assets has partnered with DLP Capital to bring this investment opportunity to our investors. We’ve partnered with DLP capital because they are one of the nation’s leading private financial services and fully integrated real estate firms focused on IMPACT solutions targeting the nation’s largest crises through lending and investment products, services, education, and systems. Our goal with the Impact Lending Fund is to provide our investors with a better option for their short term capital needs.

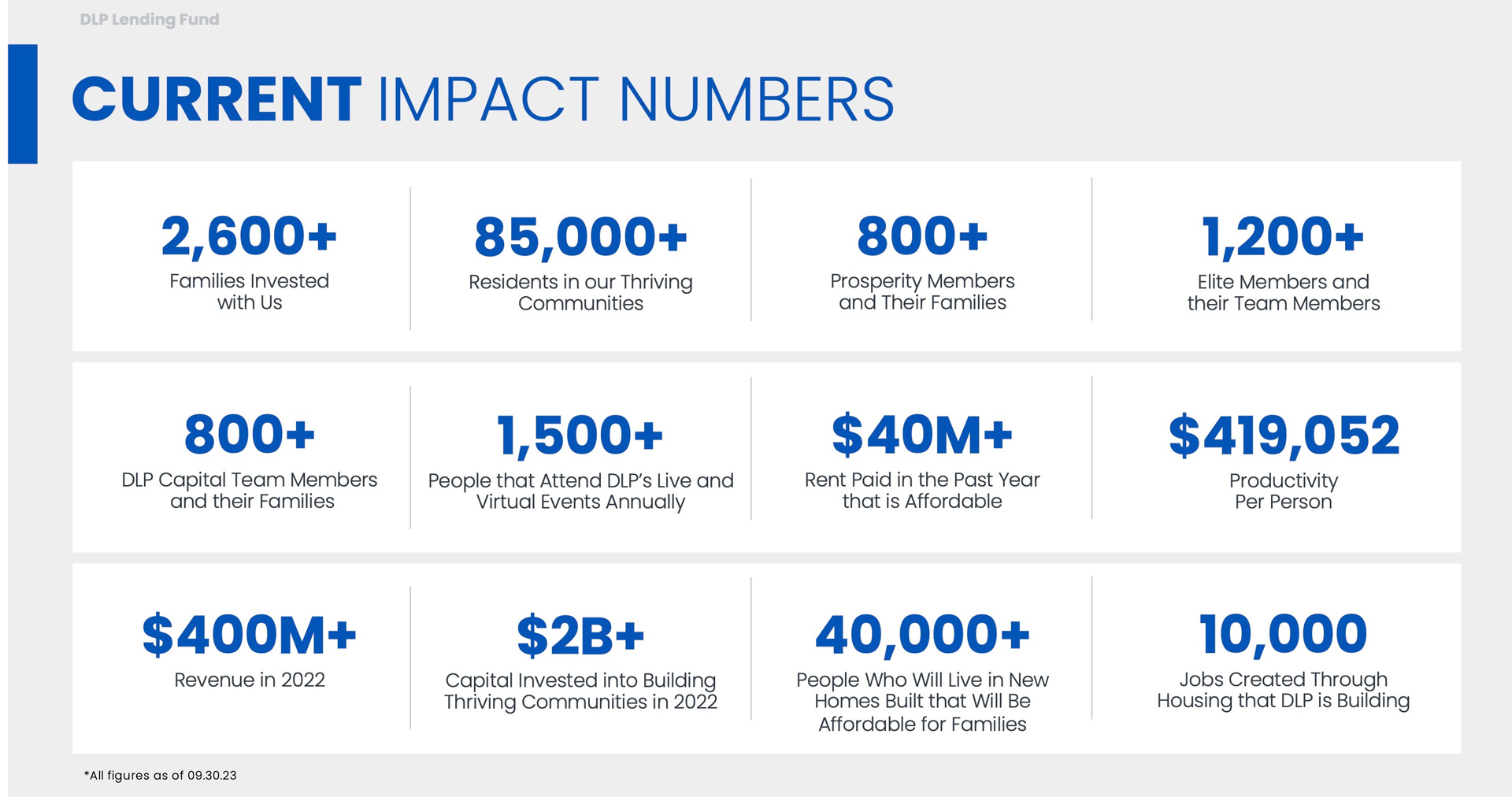

Impact by the numbers

DLP is a faith-based company that has been growing and helping communities since focusing on the crises of Housing, Jobs, Legacy and Happiness.

Founded in 2006, DLP Capital continues meteoric growth, with the firm ranking on the Inc. 5000 list of “Fastest Growing Private Companies in America” for 11 consecutive years—among the few companies on the list to achieve such growth consistently.

The firm now has more than $5 billion of assets under management and is headquartered in St. Augustine, Florida.

Current Numbers:

$5B+

Assets Under Management

$400M+

Total Annual Revenue

40,000

Units Invested In

11 Years

In a row on the Inc. 5000 Fastest Growing Companies list

Investment Thesis

1 – BASIS INVESTORS

Stringent analysis of the price/basis of properties prior to investing

2 – GEOGRAPHIC FOCUS

Most attractive areas in Southeast, Sunbelt, and Texas in Tier 2 and 3 markets

3 – PROPERTY TYPE

Multifamily apartments and single-family rental (BTR) will continue to grow

4 – AFFORDABLE HOUSING

Targeted to invest in housing with rent:income ratio below 30% (historical average 21-22%)

5 – COMMUNITY DRIVEN

Building engagement and solutions for families to extend tenancy and improve income

Lending Fund Overview

A highly diversified fund that offers consistent returns, liquidity, and a lower risk profile to comparable funds.

→ Senior Secured Mortgage Pool Fund (REIT)

→ 8-9% targeted net return distributed monthly

→ No management fee from Impact Lending Fund, LLC

→ 1st position mortgages backed by real estate along with personal guarantees

Lending Criteria

HIGH-DEMAND ASSET TYPES

Single-family, multifamily, and RV communities

- Existing and new construction rental single- family homes and communities

- Existing and new construction multifamily communities

- Existing and new construction RV communities

VERIFIED TRACK RECORD

Borrowers must possess strong record of acquiring, exiting or property management

- Thorough analysis of borrower’s ability to stabilize and manage properties

- Evaluate borrower’s past record of flipping properties for profit within a reasonable timeframe

QUALITY LOCATIONS

Attractive markets with strong underlying fundamentals

- We only lend to Elite Members in these regions: MidWest, CO, WY, MT, VA, WV, NJ, DE, LA, MS, AL, AR, OK.

- We will lend to all borrowers in the following: FL, GA, NC, SC, TN, TX, PA

- Preferred markets feature +100k population sizes, above-average economic opportunity

BALANCED RISK

Disciplined approach to risk management

- We strictly lend only in asset classes & geographies where we have personal experience

- DLP typically requires various loan reserves to mitigate risk

- Loan proceeds are distributed in proportion to borrower’s project completion